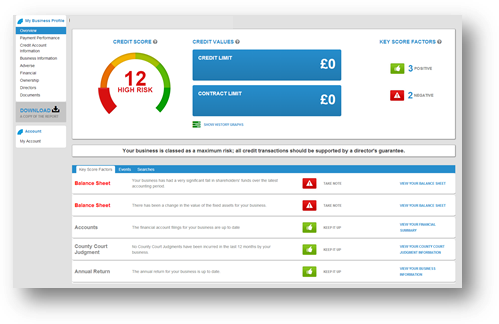

My Business Profile

What does your credit report say about your business?

✔ See your Business Credit report

✔ Improve your Business Credit Score

✔ Ensure your report is up to date

✔ Protect your Business from fraud

✔ 3 months free trial

✔ Improve your Business Credit Score

✔ Ensure your report is up to date

✔ Protect your Business from fraud

✔ 3 months free trial

Value To You

Your Company credit report is vital to your business’s success.

Why?

It’s simple…whether you’re applying for finance with a lender; credit with another business, competing in a tender process or simply trying to get a good deal on your business mobile contract, your company credit score will most likely play a role.

Why?

It’s simple…whether you’re applying for finance with a lender; credit with another business, competing in a tender process or simply trying to get a good deal on your business mobile contract, your company credit score will most likely play a role.

SMEs are particularly vulnerable to economic changes, so a strong credit score can help you to access the right type of finance for your business during difficult times. Don’t always assume that your positive personal credit score will be reflected in your company credit score. Whilst suppliers may initially consider your personal credit score, once you start paying bills and get your company running, it’ll be your company credit score they look at. Having a positive company credit score could help your company achieve more competitive loan rates and terms.

It’s why Advantage have partnered with Experian and their My Business Profile service.

It means you can view and monitor your company credit report so you can see where your business stands right now, avoiding any nasty surprises. From there you can see the details published about you, correct any mistakes and build your credit score if you need to.

It’s as easy to understand as it’s comprehensive in its detail so you know you’re getting the full picture, and there’s a 50% discount for all our members.

It’s why Advantage have partnered with Experian and their My Business Profile service.

It means you can view and monitor your company credit report so you can see where your business stands right now, avoiding any nasty surprises. From there you can see the details published about you, correct any mistakes and build your credit score if you need to.

It’s as easy to understand as it’s comprehensive in its detail so you know you’re getting the full picture, and there’s a 50% discount for all our members.